Inflation, a fundamental concept in economics, is often regarded as a silent force that shapes the economic landscape in profound ways. As prices rise, the value of money diminishes, impacting consumers and businesses alike. The intricate interplay between inflation types, measurement methodologies, and the consequences of inflation warrants a closer examination. By unraveling the complexities of inflation, one can gain insights into the broader implications it has on economies worldwide.

Key Takeaways

- Inflation is a general increase in prices of goods and services.

- Understanding different types of inflation helps in economic planning.

- Monitoring inflation is crucial for maintaining price stability and growth.

- Controlling inflation is essential for sustainable economic development.

Understanding Inflation

In the realm of economic analysis, understanding inflation is paramount for grasping the intricate interplay between price levels and purchasing power over time. Inflation refers to the general increase in prices of goods and services, leading to a decline in the value of a unit of currency. The Consumer Price Index (CPI) is a key metric used to measure inflation by tracking the prices of a basket of consumer goods and services over time. As prices rise, the purchasing power of consumers diminishes, impacting their ability to buy the same quantity of goods and services as before.

The Federal Reserve closely monitors inflation as part of its mandate to maintain price stability and promote maximum sustainable employment. Maintaining a stable inflation rate is crucial for a healthy economy, as excessively high inflation erodes consumer purchasing power, while deflation can lead to economic stagnation. Finding the delicate balance that sustains growth without causing runaway inflation is a continuous challenge for policymakers and economists alike.

Causes of Inflation

Understanding the causes of inflation is essential for comprehending the intricate dynamics that influence the fluctuations in price levels within an economy. To delve into this phenomenon, we must explore various factors that contribute to inflationary pressures:

- Demand-pull inflation: This occurs when aggregate demand surpasses the economy's production capacity, leading to an increase in prices.

- Cost-push inflation: Arising from heightened production costs being passed on to consumers, this inflationary pressure results in price hikes.

- Built-in inflation: This type stems from rising wages triggered by previous price increases, fostering a cycle of wage-price spirals that contribute to inflation.

- Supply shocks: Events like natural disasters can disrupt production and supply chains, leading to cost-push inflation.

Moreover, sudden spikes in consumer spending or investment, known as demand shocks, can also exacerbate inflation by outstripping supply. By comprehending these causes, policymakers and individuals can better navigate the complexities of inflationary forces within an economy.

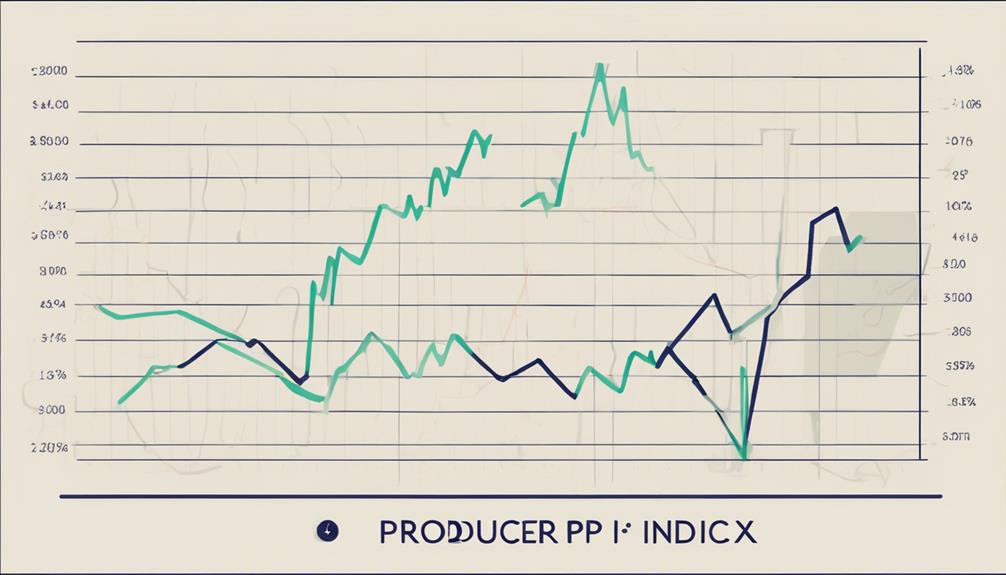

Types of Price Indexes

Price indexes play a crucial role in monitoring and analyzing changes in the prices of goods and services within an economy. The Consumer Price Index (CPI) tracks prices paid by consumers, offering insights into inflation trends affecting households. The Wholesale Price Index (WPI) focuses on changes in wholesale prices of goods, providing valuable information for businesses. Meanwhile, the Producer Price Index (PPI) measures fluctuations in prices received by domestic producers for their goods, aiding in understanding production cost dynamics. These indexes serve as essential tools for policymakers to gauge inflationary pressures and make informed decisions. By examining price indexes, policymakers can assess changes in purchasing power, identify potential economic challenges, and formulate strategies to address them effectively. Understanding the implications of price indexes on the economy is vital for maintaining stability and fostering growth. Policymakers rely on these indicators to navigate economic conditions and implement appropriate measures to regulate inflation and support sustainable economic development.

Measuring Inflation Formula

The measurement of inflation involves applying a specific formula to compare the current price level with a designated base year. This calculation is crucial in understanding the changes in overall price levels over time. The formula commonly used to calculate inflation is ((Current CPI – Base CPI) / Base CPI) x 100. Inflation rates can be annualized to show the yearly percentage change, providing a clearer picture of price movements. Indexes such as the Consumer Price Index (CPI) and the Wholesale Price Index (WPI) are essential tools in measuring inflation. The Bureau of Labor Statistics often utilizes these indexes to track inflation rates and analyze economic trends. By using the base year as a reference point, the formula helps economists and policymakers gauge the rate of price increase accurately.

Advantages and Disadvantages of Inflation

Inflation presents a dual-edged sword in the realm of economic dynamics, offering both advantages and disadvantages that significantly impact various sectors of the economy. Advantages of inflation include boosting asset prices, stimulating spending and investment, and supporting economic growth. This can lead to increased economic activities and lower real debt burdens for borrowers. However, inflation also brings disadvantages, such as eroding purchasing power, creating uncertainty for businesses, and distorting relative prices and wages. High inflation levels can destabilize economies, reduce real incomes, and lead to inefficient resource allocation. Balancing the benefits and drawbacks of inflation is crucial for policymakers to maintain a healthy economy. Central banks often use monetary policy tools to manage inflation rates, aiming to strike a balance that promotes economic growth while keeping inflation in check. Understanding the impacts of inflation on consumer price index (CPI), purchasing power, price index (PPI), asset prices, real incomes, and resource allocation is essential for informed decision-making in economic policy.

Controlling Inflation

Central banks play a pivotal role in controlling inflation through the implementation of contractionary policies like adjusting interest rates. Additionally, factors such as supply and demand dynamics, as well as the overarching goal of maintaining price stability, are integral to managing inflationary pressures effectively. By employing various strategies and frameworks, central banks strive to keep inflation within a targeted range, influencing both short-term measures like price controls and long-term inflation expectations.

Central Bank Policies

Implementing appropriate monetary policies is crucial in effectively managing inflation rates to ensure economic stability. Central banks play a key role in controlling inflation through various strategies:

- Contractionary Policies: Central banks use measures like raising interest rates to combat inflationary pressures.

- Fixed Exchange Rate Regimes: These regimes can assist central banks in effectively managing and stabilizing inflation rates.

- Target Inflation Rate: Central banks set specific inflation targets to maintain price stability within the economy.

- Inflation Targeting: This practice involves central banks explicitly setting and communicating inflation targets to guide monetary policy decisions and shape inflation expectations in the economy.

Supply and Demand

Efficient management of inflation rates hinges on the delicate balance between supply and demand dynamics within an economy. Supply shocks, like those caused by natural disasters, can lead to cost-push inflation, while demand shocks, such as excessive consumer demand, can result in demand-pull inflation. Balancing supply and demand to prevent inflation is a key challenge for policymakers. Governments may also administratively set prices to curb inflationary pressures in the economy. By understanding these factors and their interplay, policymakers can implement strategies to control inflation effectively. The table below summarizes the key points related to supply and demand dynamics in controlling inflation:

| Supply Shocks | Demand Shocks | Other Factors |

|---|---|---|

| Natural disasters | Excessive consumer demand | Administratively set prices |

| Cost-push inflation | Demand-pull inflation | Inflationary pressures |

Price Stability Goals

Achieving price stability through effective inflation control is paramount for fostering sustainable economic growth and maintaining financial equilibrium.

- Central banks aim for a stable inflation rate around 2% to maintain price stability and economic growth.

- The Federal Reserve uses monetary policy tools like interest rates to control inflation and prevent excessive price increases.

- High inflation can erode purchasing power and lead to economic instability, impacting businesses and consumers.

- Controlling inflation is crucial for promoting investment, maintaining confidence in the economy, and supporting sustainable growth.

Balancing inflation targets with other economic objectives like employment is a key challenge for policymakers. Central banks play a vital role in ensuring that price stability is maintained through appropriate monetary policy measures, ultimately contributing to a healthy and thriving economy.

Examples of Inflation

In examining examples of inflation, it is crucial to analyze the causes behind its occurrence, its profound impact on the economy, and the strategies implemented to control its escalation. By scrutinizing the historical context and recent instances of inflation rates, we can gain insights into the dynamics of price increases, economic stability, and policy responses. Understanding these real-world examples of inflation provides a foundation for comprehending its complexities and implications for various stakeholders.

Causes of Inflation

Frequently, inflation is triggered by either demand-pull factors, where consumer demand surpasses production capacity, or cost-push factors, stemming from increased production costs.

- Demand-pull inflation occurs when consumer demand outstrips production capacity, leading to price increases.

- Cost-push inflation arises from rising raw material prices and supply chain disruptions, impacting the cost of goods.

- Escalating input costs contribute to inflationary pressures, affecting final product prices.

- Effective management of inflation involves implementing strategic pricing strategies to navigate the challenges posed by demand and cost fluctuations.

Understanding the interplay between consumer demand, production capacity, input costs, and pricing strategies is crucial in addressing the complex dynamics that drive inflation.

Impact on Economy

The impact of inflation on an economy can be profound, influencing various economic indicators and shaping overall financial conditions. Inflation erodes purchasing power and reduces real income, leading to economic instability and hindering long-term growth prospects. Businesses may face challenges such as declining profit margins and pricing difficulties during high inflation periods. When inflation outpaces wage growth, household budgets can be strained, resulting in reduced consumer spending. To maintain price stability and stimulate economic activity, controlled inflation around 2% is considered healthy. Below is a table illustrating the impact of inflation on the economy:

| Economic Indicator | Impact of Inflation |

|---|---|

| Purchasing Power | Eroded for consumers |

| Profit Margins | Decline, posing pricing challenges for businesses |

| Wage Growth | Lagging behind inflation rates, affecting household budgets and consumer spending |

| Price Stability | Controlled inflation around 2% is optimal for maintaining stable economic conditions |

Controlling Inflation

During periods of heightened inflation like those experienced in the past, implementing effective strategies to control inflation becomes imperative for maintaining economic stability and fostering sustainable growth. To combat rising prices and control inflation, several key measures are essential:

- The Federal Reserve historically raises interest rates to curb inflation.

- Supply chain disruptions and evolving consumption patterns influence current inflation trends.

- Companies adjust prices to offset increased input costs and sustain profitability.

- Implementing policies to control inflation is crucial to ensure long-term economic stability and growth.

Effects of Inflation

Inflation's impact on individuals' purchasing power can be significant, especially when nominal income fails to keep pace with rising prices. This can lead to a reduction in real income, affecting consumers' ability to buy goods and services. Uneven price increases can also erode purchasing power for certain groups, particularly those on fixed incomes. Fixed interest rates in the face of inflation can further distort purchasing power over time.

| Effects of Inflation | |

|---|---|

| Reduces Real Income | Nominal income not keeping up with rising prices can lead to a decrease in purchasing power. |

| Erodes Purchasing Power | Uneven price increases can diminish the ability of certain consumers to afford goods and services. |

| Distorts Fixed Incomes | Fixed interest rates can distort purchasing power over time when inflation occurs. |

| Disastrous for Economies | High inflation and hyperinflation can have devastating consequences on economic activity and growth. |

Frequently Asked Questions

What Is Inflation in Simple Terms?

In simple terms, inflation refers to the general increase in consumer prices over time. It is influenced by factors such as the money supply, wage growth, cost-push pressures, and demand-pull dynamics. Central banks monitor inflation closely to maintain price stability, support economic growth, and protect the purchasing power of currency. Interest rates are often adjusted to manage inflation levels effectively. Understanding inflation is crucial for making informed financial decisions and policy choices.

What Are the 3 Main Causes of Inflation?

The three main causes of inflation are demand-pull, cost-push, and wage spiral. Demand-pull inflation originates from excessive aggregate demand surpassing an economy's capacity. Cost-push inflation results from increased production costs like wages or raw materials. Wage spiral inflation occurs due to workers demanding higher wages to match rising prices. These causes, influenced by market forces, monetary policy, and supply constraints, impact the price level, often affected by external shocks and structural factors amid economic growth.

Why Is Inflation Still so High?

Economic factors, such as supply chain disruptions and increased consumer demand, have contributed to persistently high inflation rates globally. Governments' policies, including accommodative measures by central banks, have also influenced inflation levels. Additionally, rising wage growth and fluctuating currency values impact price levels. Market trends and interest rates further play a role in sustaining high inflation rates. Understanding consumer behavior in this context is crucial for assessing and addressing the ongoing inflationary pressures.

Who Benefits From Inflation?

Inflation redistributes wealth, benefiting debtors by allowing repayment with devalued money, while creditors suffer from reduced real returns. Stock market and real estate investors typically see gains as asset prices rise. Wage earners may face challenges as wage growth lags behind inflation. Governments benefit from reduced debt burdens, but international trade may be affected by inflation. Interest rates, retirement savings, and economic growth are also influenced by inflation dynamics.

Conclusion

In conclusion, inflation is a persistent rise in the general price level of goods and services within an economy, leading to a decrease in the purchasing power of a currency over time. It is crucial for policymakers and individuals to be aware of the causes, types, and impacts of inflation in order to effectively navigate its implications. Ultimately, understanding inflation is essential for maintaining economic stability and promoting sustainable growth in the long run.